In the complex environment of the modern business world, it is of the utmost importance to keep correct financial records to achieve success. Even though it is sometimes disregarded or undervalued, bookkeeping is the foundation of financial management for companies of all kinds.

The benefits of efficient bookkeeping permeate every part of operations, influencing decision-making, compliance, and the general profitability of a business. This is true for both newly created businesses and those that have been around for a long time.

In this article, we look into the essential importance of bookkeeping in several aspects of the company, including the enhancement of business efficiency, the reduction of risks, and the promotion of growth.

You may leverage the potential of precise financial record-keeping to achieve sustainable success in today’s competitive marketplace if you have a grasp of how it can strengthen your company endeavours and how it can help you compete more effectively.

In this article, we will discuss the several ways in which proficient bookkeeping methods can have a positive impact on the trajectory of your organisation.

How Do You Think Bookkeeping Could Help Your Business?

Bookkeeping plays a pivotal role in helping businesses in numerous ways:

- Financial Clarity: Accurate bookkeeping provides a clear snapshot of your business’s financial health. By keeping track of income, expenses, assets, and liabilities, you gain insights into your cash flow, profitability, and overall financial performance. This clarity enables informed decision-making and strategic planning.

- Budgeting and Forecasting: With detailed financial records at hand, businesses can develop realistic budgets and forecasts. Bookkeeping data allows you to identify trends, anticipate future expenses, and set achievable financial goals. By aligning your budget with your business objectives, you can allocate resources effectively and optimize financial outcomes.

- Tax Compliance: Proper bookkeeping ensures compliance with tax regulations. By meticulously recording income, expenses, and deductions throughout the year, you streamline the tax filing process and minimize the risk of errors or audits. Additionally, organized financial records facilitate tax planning strategies to optimize tax efficiency and minimize liabilities.

- Monitoring Business Performance: Regular review of financial statements generated through bookkeeping enables you to monitor business performance in real-time. You can track key performance indicators (KPIs), such as profit margins, return on investment (ROI), and debt-to-equity ratio, to gauge the effectiveness of your business strategies and identify areas for improvement.

- Facilitating Financing and Investment: Lenders, investors, and potential partners often require access to accurate financial records before extending credit or entering into business agreements. Well-maintained bookkeeping instils confidence in stakeholders by demonstrating financial stability and transparency. It enhances your credibility and increases your chances of securing financing or attracting investment to fuel business growth.

- Operational Efficiency: Efficient bookkeeping processes streamline day-to-day operations by minimizing paperwork, reducing manual errors, and optimizing workflows. Automation tools and software solutions can further enhance efficiency by automating repetitive tasks, such as data entry and reconciliation, allowing you to focus on core business activities.

- Risk Management: By maintaining up-to-date financial records, businesses can identify and mitigate risks proactively. Whether it’s detecting discrepancies, identifying cash flow issues, or recognizing potential fraud, thorough bookkeeping practices serve as an early warning system, enabling timely intervention to safeguard business assets and reputation.

- Legal Compliance: Compliance with regulatory requirements and industry standards is essential for business sustainability. Proper bookkeeping ensures that financial transactions are accurately recorded and documented, facilitating regulatory compliance and reducing the risk of penalties or legal disputes.

Bookkeeping is not merely a routine administrative task; it is a strategic imperative that underpins the financial stability, growth, and resilience of your business. By embracing effective bookkeeping practices, businesses can unlock their full potential, navigate challenges, and thrive in today’s dynamic business environment.

What Is Bookkeeping?

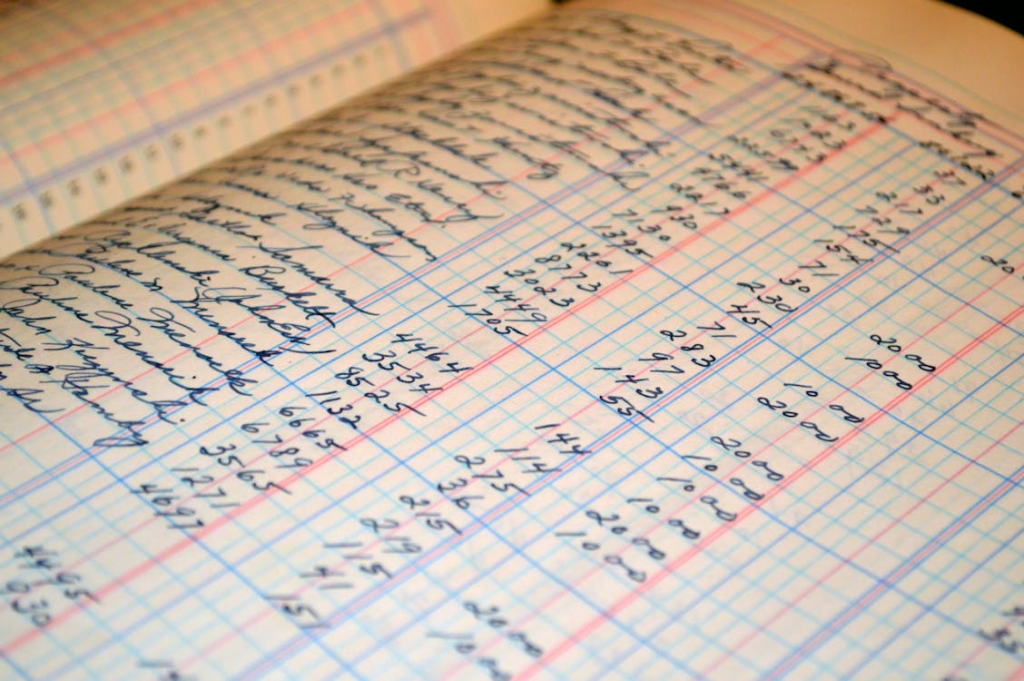

Bookkeeping is the systematic process of recording, organizing, and maintaining financial transactions and records of a business. It involves tracking all financial activities, including income, expenses, assets, liabilities, and equity, in a structured and comprehensive manner.

The primary objectives of bookkeeping are to:

- Maintain Accuracy: Ensure that financial records accurately reflect the business’s financial position and performance.

- Facilitate Decision-Making: Provide timely and reliable financial information to support informed decision-making by management.

- Ensure Compliance: Comply with regulatory requirements and financial reporting standards, including tax regulations and accounting principles.

- Support Analysis: Enable financial analysis, such as budgeting, forecasting, and performance evaluation, to assess the business’s financial health and identify areas for improvement.

Bookkeeping typically involves recording transactions in journals, posting them to ledgers, and preparing financial statements such as the income statement, balance sheet, and cash flow statement. Various methods and systems, including manual entry and computerized accounting software, are used to perform bookkeeping tasks efficiently.

What Is The Main Purpose Of Bookkeeping?

The main purpose of bookkeeping is to systematically record and track the financial transactions of a business in an organized manner. This process serves several critical functions:

- Recording Financial Transactions: Bookkeeping involves recording all financial transactions, including income, expenses, assets, liabilities, and equity, in a systematic and chronological order. This creates a comprehensive and accurate record of the business’s financial activities.

- Maintaining Financial Accuracy: By accurately recording financial transactions, bookkeeping ensures that the business’s financial records reflect its true financial position. This accuracy is essential for making informed decisions, complying with tax regulations, and demonstrating transparency to stakeholders.

- Tracking Financial Performance: Bookkeeping allows businesses to monitor their financial performance over time by generating financial statements such as the income statement, balance sheet, and cash flow statement. These statements provide insights into profitability, liquidity, solvency, and overall financial health.

- Facilitating Financial Analysis: The organized financial data produced through bookkeeping enables businesses to conduct meaningful financial analysis. By analyzing trends, ratios, and performance metrics, businesses can identify strengths, weaknesses, opportunities, and threats, and make informed strategic decisions.

- Supporting Tax Compliance: Proper bookkeeping ensures that businesses maintain accurate records of income, expenses, and deductions, which are essential for complying with tax regulations. By keeping thorough records, businesses can prepare accurate tax returns, minimize tax liabilities, and avoid penalties or audits.

- Enabling Decision-Making: Bookkeeping provides decision-makers with timely and relevant financial information to support strategic decision-making. Whether it’s budgeting, forecasting, pricing, or investment decisions, access to reliable financial data is crucial for evaluating options and choosing the most viable course of action.

- Facilitating Audits and Due Diligence: Organized financial records produced through bookkeeping facilitate audits by external parties, such as tax authorities or investors. Additionally, during due diligence processes for mergers, acquisitions, or financing, thorough bookkeeping demonstrates the business’s financial stability and transparency.

The main purpose of bookkeeping is to accurately record, organize, and track financial transactions to support informed decision-making, ensure compliance with regulations, and facilitate financial transparency and accountability within a business.

Conclusion

Accounting serves as the foundation of a company’s financial management system, playing critical roles that are crucial to the company’s performance and long-term viability.

Bookkeeping provides businesses with precise insights into their financial health to facilitate informed decision-making and strategic planning. This is accomplished through the systematic recording and organisation of financial transactions.

The maintenance of financial precision, the tracking of performance, and compliance with regulatory standards are all attainable for organisations that employ rigorous bookkeeping techniques. Furthermore, the organised financial data that is produced makes analysis easier, helps with tax compliance, and increases transparency for the many stakeholders.

When it comes down to it, efficient bookkeeping is not only a bureaucratic duty; rather, it is a strategic imperative that enables firms to navigate hurdles, grasp opportunities, and accomplish their objectives.

Businesses can optimise their financial management procedures and set the road for long-term growth and prosperity if they acknowledge the relevance of bookkeeping and put in place sound standards.

Looking for a trusted bookkeeping service? Here are 2peas to help you! Book your appointment today!

Leave a Reply